- MoonCrawler

- Posts

- Money Smarts: 5 Fun Ways to Teach Financial Literacy to Young Children

Money Smarts: 5 Fun Ways to Teach Financial Literacy to Young Children

(Snippet)

In today’s fast-paced world, teaching financial literacy early can set your child up for a lifetime of smart money management. This week, we’ll explore five fun and engaging ways to teach young children about the value of money, saving, and spending wisely.

Introduction

Financial literacy is an essential skill for every child, and starting young can provide them with the tools they need to make informed financial decisions later in life. Teaching kids about money doesn’t have to be boring or complicated! By incorporating simple, practical lessons in day-to-day activities, parents can help their children understand the basics of earning, saving, and spending responsibly. This week’s newsletter focuses on five creative ways to introduce financial literacy to your children in a way they’ll enjoy and remember.

Why teaching Financial Literacy is Important?

As the world becomes increasingly reliant on credit and digital money, it’s more crucial than ever to instill strong financial values in children early. A 2022 study by Cambridge University found that children’s money habits are formed by age 7, making early education vital for long-term financial health. By teaching financial literacy to young children, parents can encourage a healthy attitude toward money that will last well into adulthood.

5 Fun Ways to Teach Financial Literacy to Young Children

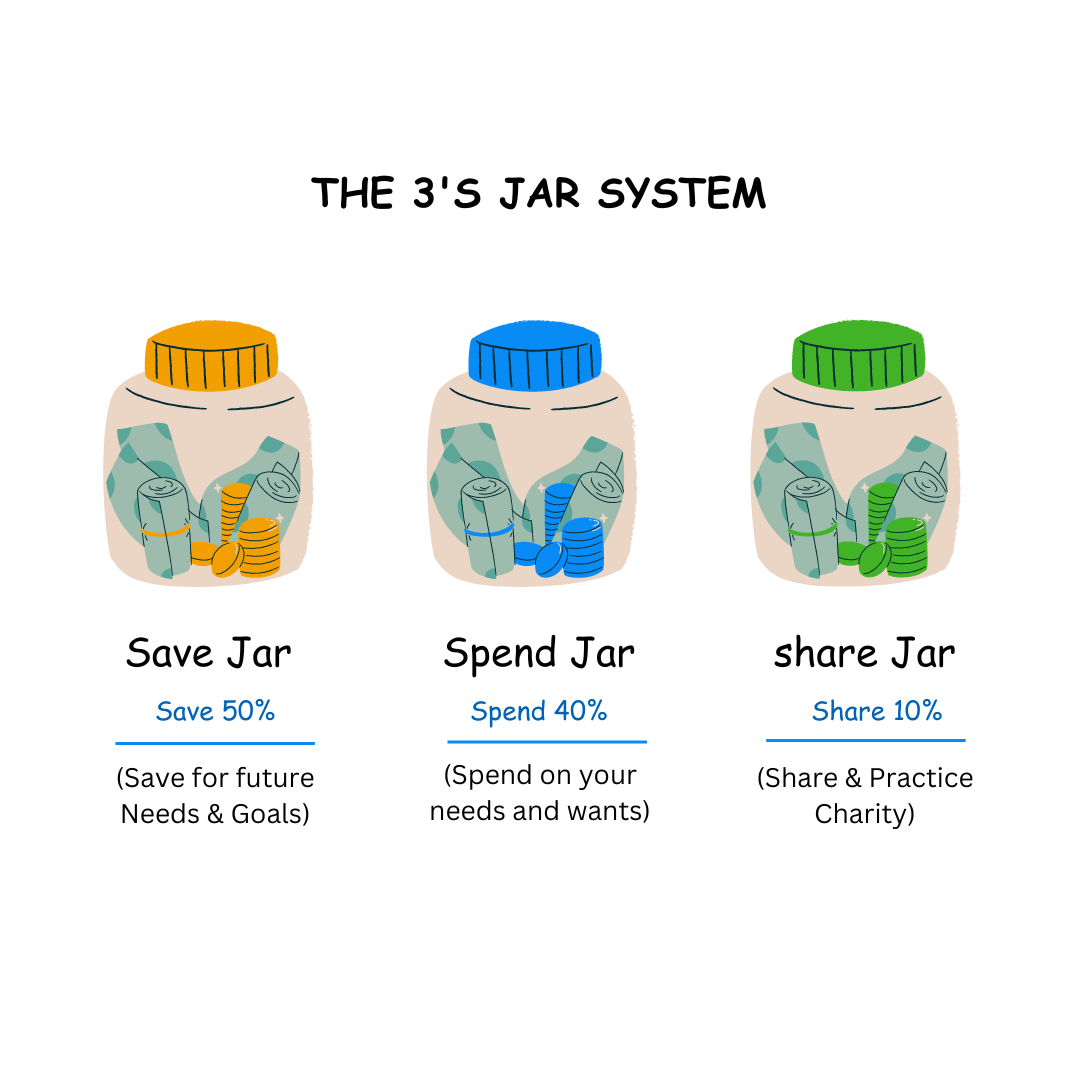

One of the easiest and most effective ways to teach young children about money is through the jar system. This method encourages kids to divide any money they receive into three jars: Save, Spend, and Share.

How to Use It? - Label three clear jars with the words "Save," "Spend," and "Share." Whenever your child receives money (from allowances, birthdays, etc.), guide them to divide it into these categories. The "Save" jar is for future goals, the "Spend" jar is for things they want now, and the "Share" jar is for donations or gifts. The proportion could be 50% in the Save Jar, with the remaining 40% and 10% in the Spend and Share Jars, respectively. While teaching about the Spend Jar, explain the difference between needs and wants. Needs could include basic necessities, such as stationery or clothes, whereas wants are desires for things they simply wish to have.

Example - If your child receives ₹1,000, you might suggest putting ₹500 in savings, ₹400 in spending, and ₹100 in sharing. Over time, they’ll see their savings grow, learn budgeting, and experience the joy of giving back.

2. Make Shopping a Teachable Moment

Every trip to the store can be an opportunity to teach your child about money, budgeting, and the value of items. Engage them in conversations about how much things cost and help them understand the difference between needs and wants.

Practical Tip - When grocery shopping, involve your child by giving them a small budget to pick out a few items. Teach them to compare prices and make choices based on their budget. You can also teach them how to negotiate by involving them in interactions with the seller.

Example - Let’s say your child has ₹50 to buy a snack. Teach them how to look for deals or prioritize what they really want. For instance, they may initially plan to buy wafers but could come across other appealing items while shopping. This exercise helps them understand budgeting and making informed choices.

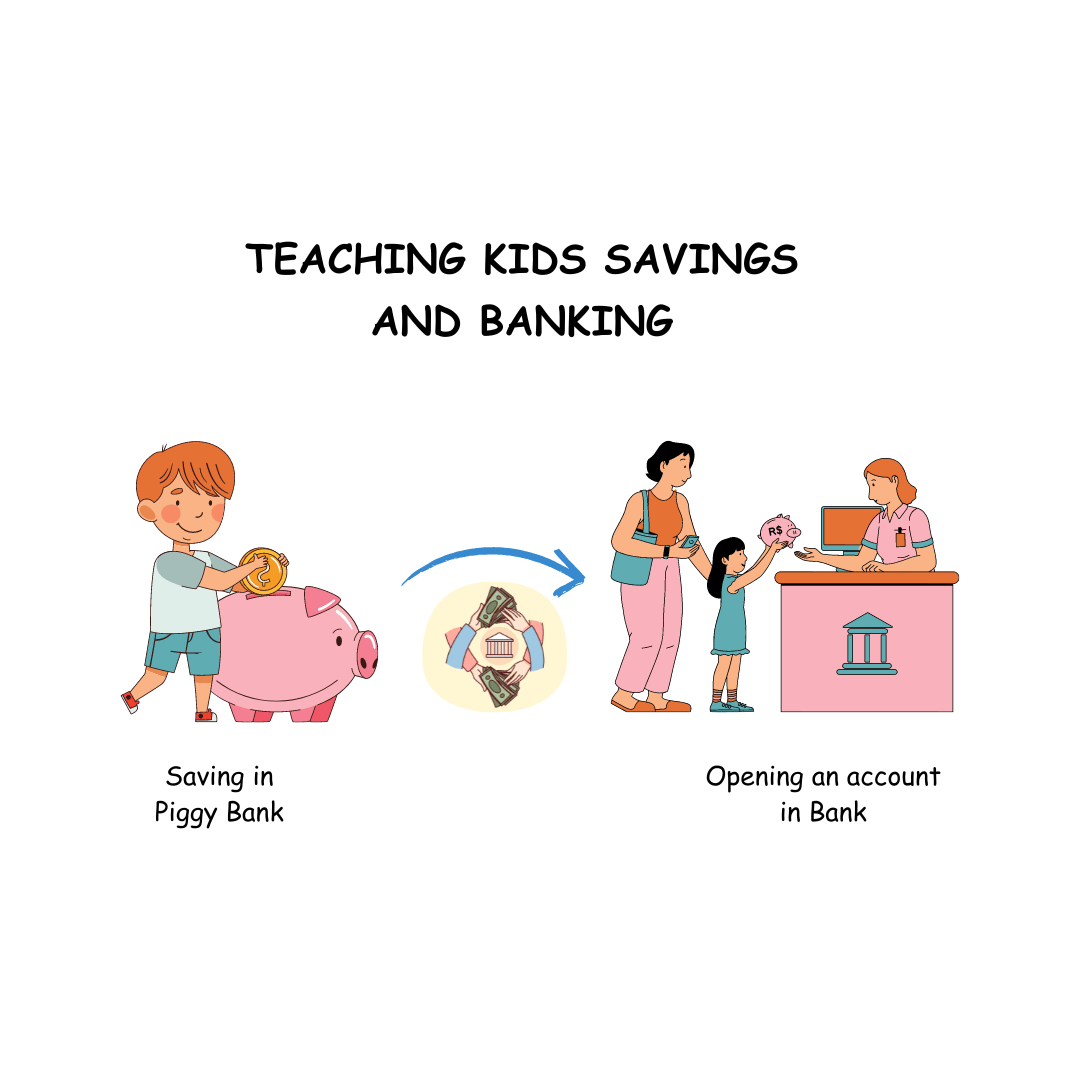

3. Introduce Them to a Piggy Bank or a Bank Account

A piggy bank is a classic way to encourage saving. As children grow older, transitioning from a piggy bank to a child’s savings account can help them understand how banks work and the concept of earning interest.

Practical Tip - Start with a colorful, fun piggy bank for younger children and gradually introduce the idea of a savings account as they grow older. Take them to the bank and show them how deposits work.

Example - Help your child set a small savings goal, like buying a toy. Watch as they save up over time, and when they reach their goal, celebrate their achievement! For older children, explain how the bank can help their money grow through interest.

4. Play Financial Literacy Games

Many educational games are designed to teach children about financial concepts in a fun, engaging way. Whether board games or apps, these games help children understand money management in an interactive environment.

Practical Tip - Introduce games like Monopoly Junior or online apps like "PiggyBot" and "Bankaroo" to teach kids about money. These games simulate real-life financial decisions, such as buying property or budgeting.

Example - While playing Monopoly Junior, explain how buying property and earning rent works, showing them how investments can grow over time. Financial apps like Bankaroo can help children manage virtual money, giving them a real-world sense of income, spending, and savings.

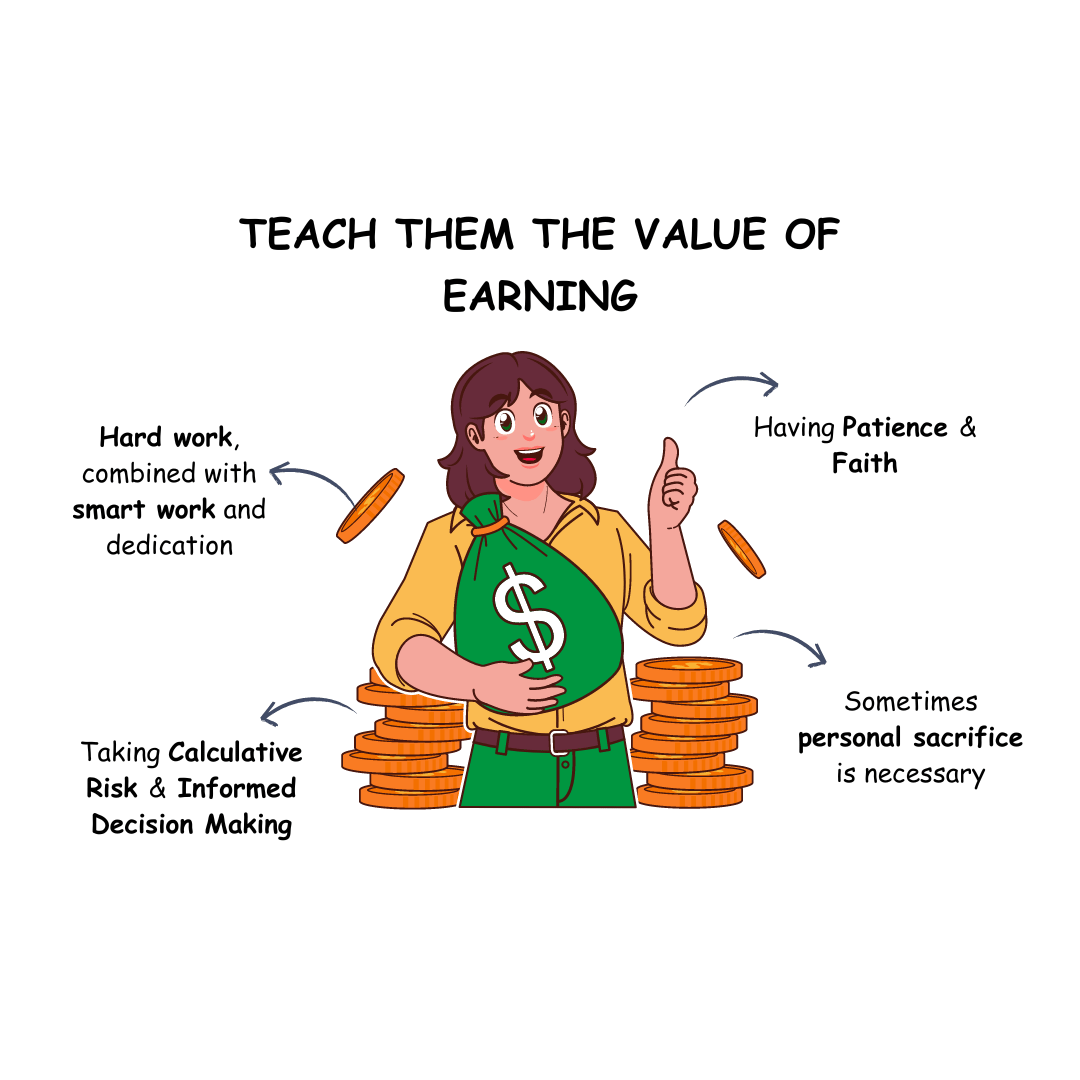

5. Teach Them the Value of Earning

Instilling the idea that money is earned, not given, is a fundamental part of financial literacy. Small chores or tasks can help children understand the concept of working to earn money. A report from LinkedIn indicated that 42% of billionaires in India come from the Marwari community. From Ambani to Adani, many Marwaris teach their children the value of money from a young age, often by involving them in family businesses and gradually teaching them money management and negotiation skills. Hence, instilling the value of earning is one of the most important lessons for kids today.

Practical Tip - Create a simple chore chart where children can earn small amounts of money for completing tasks like cleaning their room or helping with household chores. This helps them associate hard work with rewards.

Example - For each chore completed, offer a small amount, such as 50 cents or ₹10. Let them track how much they’ve earned and decide how they want to save or spend it. This will instill the value of earning and budgeting early on.

Conclusion

While it's true that money can't buy happiness—just as it can buy a bed but not sleep, or a luxury watch but not time—being financially literate and disciplined is a vital life skill that every child should learn. Financial literacy equips them to manage future expenses and plan wisely. Teaching children about money is an investment in their future. By weaving fun and practical lessons into everyday activities, parents can give their kids the tools to handle finances responsibly. Whether through saving systems or engaging games, these steps ensure that financial education is both enjoyable and impactful for your child.

MoonCrawler’s Mission and Vision

At MoonCrawler, we’re dedicated to helping parents raise well-rounded children with not only emotional intelligence but also practical life skills like financial literacy. Our mission is to create a supportive space for parents to engage with their kids on essential topics like money management, ensuring a bright and financially secure future for the next generation.

Join Our Community

Subscribe to MoonCrawler’s newsletter and stay informed on more tips, guides, and activities that can help you and your child thrive. Join a community of parents who are committed to raising financially savvy and emotionally intelligent children!